CARL WATTS & ASSOCIATES

August 10, 2015

|

Washington DC

|

tel/fax 202 350-9002 |

|

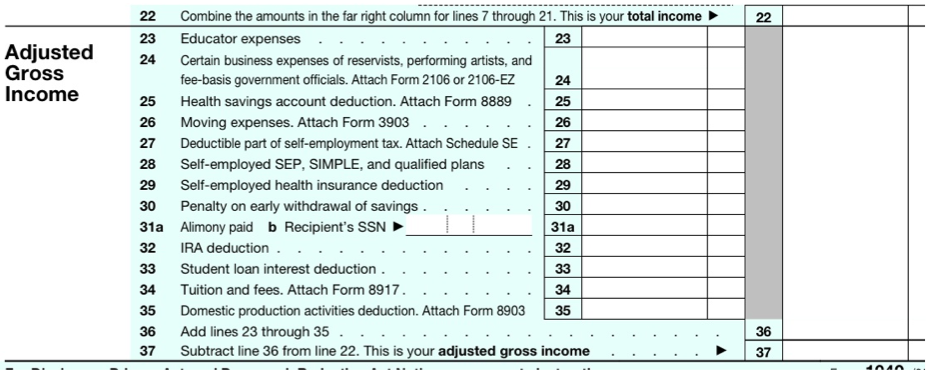

For several weeks now, we’ve been dwelling on the adjustments to income section of Form 1040. Some of these adjustments were more familiar, others not so much. But, of all the lines that make up this part of Form 1040, Line 36 might be the less known, in spite of its apparently simple content. And here is why, on Line 36 you can include a number of write-in adjustments that are only named in the Instructions to Form 1040 and not on the form itself.

|

|

|

|

|

The instructions specify that on the dotted line next to line 36, you should enter the amount of your deduction and identify it as indicated.

|

| If you want to find out what these write-in adjustments are and if you qualify for any of them, look no further, you will find the basic information right here. |

|

The Archer MSA Deduction |

|

An older relative of the HSA, the Archer MSA is generally a medical savings account set up exclusively for paying the qualified medical expenses of the account holder. |

|

|

|

To be eligible for an Archer MSA, you (or your spouse) must be an employee of a small employer or be self-employed. You (or your spouse) must be covered under a high deductible health plan (HDHP) and have no other health coverage except permitted coverage. You must not be enrolled in Medicare and cannot be claimed as a dependent on someone else's tax return. You must be an eligible individual on the first day of a month to take an Archer MSA deduction for that month. |

|

Generally, qualified medical expenses for Archer MSA purposes are unreimbursed medical expenses that could otherwise be deducted on Schedule A (Form 1040). |

|

Qualified medical expenses are those incurred by the account holder or the account holder's spouse or dependent(s). Only prescribed medicines or drugs (including over-the-counter medicines and drugs that are prescribed) and insulin (even if purchased without a prescription) for the account holder or the account holder's spouse or dependent(s), are qualified medical expenses. |

|

|

|

|

You cannot treat insurance premiums as qualified medical expenses unless the premiums are for long-term care (LTC) insurance, health care continuation coverage, or health care coverage while receiving unemployment compensation under federal or state law.

|

| The amount you can deduct for Archer MSA contributions is limited by: |

|

|

|

Any employer contributions made to your Archer MSA prevent you from making deductible contributions. Also, if you or your spouse made contributions in addition to any employer contributions, you may have to pay an additional tax. You cannot deduct any contributions you made after you became enrolled in Medicare, or if you can be claimed as a dependent on someone else's tax return.

|

|

You must figure your Archer MSA deduction on Form 8853 and identify it as “MSA” on Line 36 of Form 1040.

|

Write-In Deductions

|

Troubles viewing this message? View in browser online here

|

| The Jury Duty Pay Deduction |

| Jury duty pay you receive must be included in your income on Form 1040, line 21. If you gave any of your jury duty pay to your employer because your employer continued to pay you while you served jury duty, include the amount you gave your employer as an income adjustment on Form 1040, Line 36 and identify it as “Jury Pay.” |

| Attorney Fees and Court Costs Deduction |

| You may be able to deduct attorney fees and court costs paid to recover a judgment or settlement for a claim of unlawful discrimination but only to the extent of gross income from such actions. |

| Once again, you can claim this deduction as an adjustment to income on Form 1040, Line 36 and identify it as “UDC.” |

|

You may also be able to deduct attorney fees and court costs you paid in connection with an award from the IRS for information you provided that helped the IRS detect tax law violations, up to the amount of the award includible in your gross income. This should be identified as “WBF.” |

|

Another adjustment to income that may be included on Line 36 refers to expenses related to income reported on Line 21 from the rental of personal property engaged in for profit. |

| If you are not in the business of renting personal property, you must report your rental income on line 21 of Form 1040. If you rent personal property for profit, include your rental expenses in the total amount you enter on line 36 of Form 1040 and identify the amount as "PPR" on the dotted line to the left. |

|

|

If you do not file Schedules C or F and you are not in a partnership or S Corporation, you can deduct reforestation amortization and expenses on Line 36 and identify the amount as “RFST.” |

|

Repayment of supplemental unemployment benefits under the Trade Act of 1974 can be deducted on Line 36 as well and is identified as “Sub-Pay TRA.” |

|

If you make contributions to section 501(c)(18) (D) pension plans, which are employee funded pension trust created before June 25, 1959, you may deduct the amount deferred subject to the limits that apply. Include your deduction in the total on Form 1040, line 36 and enter the amount and “501(c)(18)(D)” on the dotted line next to line 36. |

| Contributions by certain chaplains to section 403(b) plans is another item which may be included on Lime 36 and identified as “403(b).” If you are a chaplain and your employer does not exclude contributions made to your 403(b) account from your earned income, you may be able to take a deduction for those contributions on your tax return. However, if your employer has agreed to exclude the contributions from your earned income, you will not be allowed a deduction on your tax return. |

| When it comes to matters related to taxes (and not only) there is no formula to fit each and every situation, and it is quite easy to overlook such less known adjustments to income as the ones mentioned above. This is one more reason why help from a tax professional can be, most often than nor, invaluable. |

|