CARL WATTS & ASSOCIATES

February 04, 2013

|

Washington DC

|

tel/fax 202 350-9002 |

|

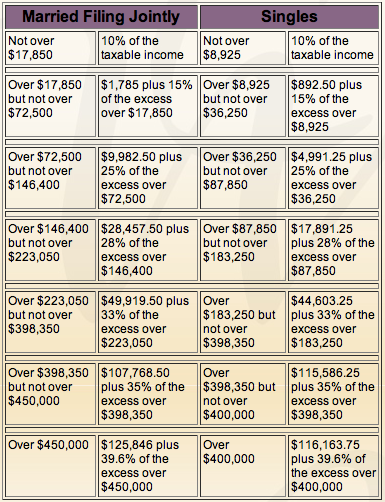

By law, a number of tax provisions must be adjusted annually to keep pace with inflation, therefore, on January 28, 2013, the IRS released Revenue Procedure 2013-15, published in Internal Revenue Bulletin 2013-5, which sets forth the inflation adjusted items for year 2013, including tax rate schedules and other tax changes specified in the American Taxpayer Relief Act of 2012. Some adjustments were announced as early as October last year in Revenue Procedure 2012-41.

|

||||||||||||||||||

|

Below are the most relevant inflation adjustments for the year 2013.

|

||||||||||||||||||

|

|

||||||||||||||||||||||

|

|

||||||||||||||||||||||

|

||||||||||||||||||||||

|

||||||||||||||||||||||

|

||||||||||||||||||||||

|

||||||||||||||||||||||

|

The IRS began processing most individual income tax returns on Jan. 30 after updating forms and completing programming and testing of its processing systems.

Returns claiming education credits (Form 8863) will be processed only as of Mid-February. |

||||||||||||||||||||||

|

As always, we’ll keep you updated with the latest information of interest to you.

|

||||||||||||||||||||||

|

|

||||||||||||||||||||||

|

|

|

Troubles viewing this message? View in browser online here

|