CARL WATTS & ASSOCIATES

February 11, 2013

|

Washington DC

|

tel/fax 202 350-9002 |

|

You may be a taxpayer who prefers to have a professional prepare his or her tax returns; you may be a computer proficient, in which case the tax software you use automatically chooses the best form for your particular situation; or you may be a do-it-yourself, pen to paper taxpayer.

|

|

In any of these cases, we think it is useful for you to know which 1040 Form is best for your particular situation and why.

|

|

As a general rule, the simplest tax form for your needs is the best choice. This usually saves time in preparing the return, and also allows the IRS to process the tax return more quickly.

|

|

While all the personal income tax forms are designed to get the appropriate amount of your money to the IRS, the differences in these returns could cost you if you're not well informed.

|

|

|

|

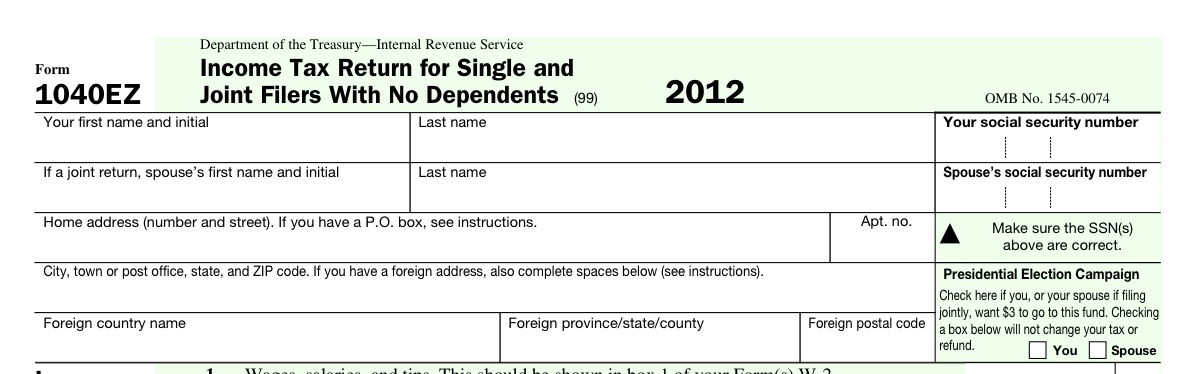

The IRS tax forms range from simple to complex. The simplest form, also known as the shortest form, is the 1040EZ. The 1040A and the 1040 are designed for more complex tax returns.

|

|

There are rules and limits for each tax form. The form with the most limitations on what can be filed on a return is the 1040EZ. This one page long form is very simple so filing is quick and easy.

|

|

You can use Form 1040EZ if:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

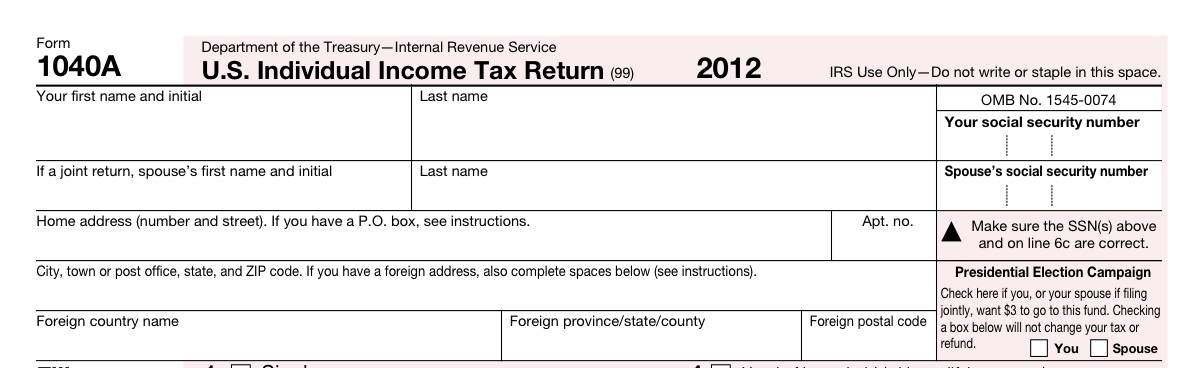

With all the restrictions for filing Form 1040EZ, it is no wonder that most taxpayers qualify to use Form 1040A, often called the "short form." This form allows you to claim the most common adjustments to income.

|

|

You can use Form 1040A if:

|

|

|

|

|

|

|

|

|

With 1040A:

|

|

|

|

|

|

|

|

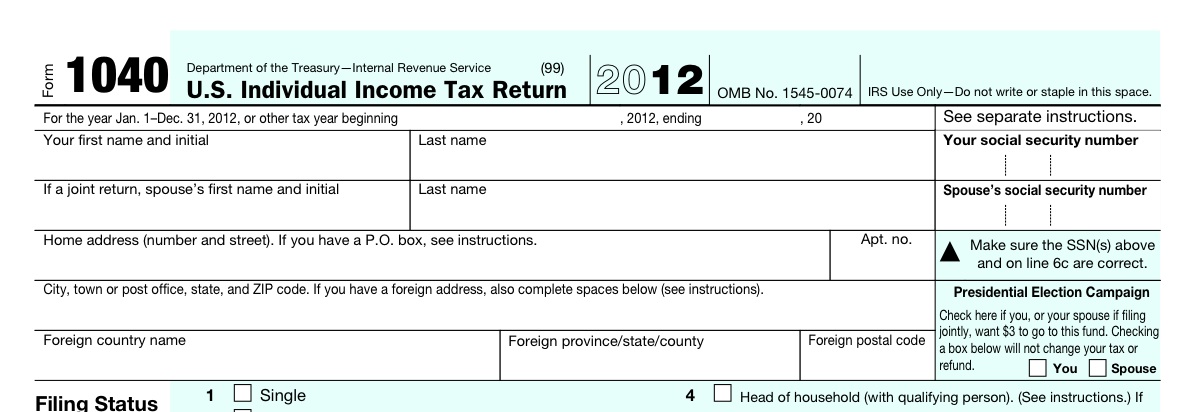

Form 1040 is the standard federal individual income tax form; with this form your tax return is free from restrictions.

|

|

The 1040 tax form is like the base form, it includes a summary of your income and tax computations. All deductions and credits are calculated on various schedules which get attached to it.

|

|

Any taxpayer can use Form 1040. Even though it takes longer to fill out, Form 1040 can handle any tax situation no matter how complex.

|

|

You must file Form 1040 when:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bottom line, if you have any doubt about what form to choose, use Form 1040, you cannot go wrong by using this tax form. With Form 1040 you can get the lowest tax by having the most possibility for credits.

|

|

Of course, complex or not so complex, your tax returns will always be in best form with the help of a tax professional.

|

Which 1040 Is Right

For You And Why

For You And Why

|

Troubles viewing this message? View in browser online here

|