CARL WATTS & ASSOCIATES

July 27, 2015

|

Washington DC

|

tel/fax 202 350-9002 |

|

With the big corporations constantly expanding into “multinationals”, the government has been looking for means to encourage domestic production and the hiring of more employees in the United States.

|

||||||||||

|

|

||||||||||

|

||||||||||

|

One of these means is the domestic production activities deduction (also referred to as the manufacturer's deduction), which is a provision enacted in the American Jobs Creation Act of 2004. Under very specific circumstances, smaller and bigger companies can benefit from the deduction, albeit it is relatively new, little known, and quite complex. This above-the-line deduction is largely regulated by the Internal Revenue Code Section 199.

|

||||||||||

| To qualify for the deduction, your business must engage in one of the following domestic production activities: | ||||||||||

|

||||||||||

|

||||||||||

|

|

||||||||||

|

||||||||||

|

||||||||||

|

||||||||||

|

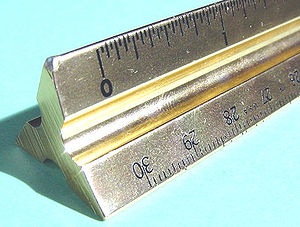

Tangible personal property includes any tangible property other than land, buildings (including structural components), computer software, sound recordings, qualified films, electricity, natural gas, or potable water. Tangible personal property also includes any gas (other than natural gas), chemical, and similar property, such as steam, oxygen, hydrogen, or nitrogen.

|

||||||||||

|

||||||||||

|

Machinery, printing presses, transportation and office equipment, refrigerators, grocery counters, testing equipment, display racks and shelves, and neon and other signs that are contained in or attached to a building constitute tangible personal property. |

||||||||||

|

|

||||||||||

|

As you can see, this is by far the broadest and most inclusive category among the ones mentioned in the list above, provided it is produced in significant part in the United States and later disposed of by sale or otherwise in the course of the business. According to the IRS, significant part means that the labor and overhead incurred in the United States were at least 20% of the total cost of the property. |

||||||||||

|

Some specific lines of business are excluded from claiming the Domestic Production Activities Deduction, such as: |

||||||||||

|

||||||||||

|

The adjustment to income itself consists of 9% deduction from net income from such activities for tax year 2014. The percentage deducted was of 3% in tax years 2005 and 2006, then increased to 6% in year 2007, and finally to 9% in year 2010 and beyond.

|

||||||||||

Domestic Production Activities Deduction

|

Troubles viewing this message? View in browser online here

|

| The deduction for domestic production activities may not exceed your adjusted gross income if you’re a sole proprietor or the owner of an LLC, partnership, or S corporation. If you own a C corporation, the deduction may not exceed the corporation’s taxable income. Thus, businesses that don’t earn a profit and pay no taxes get no domestic production activities deduction. |

| Also, the deduction cannot exceed 50% of W-2 wages paid to employees engaged in qualified domestic production activities. Payments to independent contractors (Form 1099-MISC) may not be counted as wages. |

| Individuals can claim the deduction on Form 1040, line 35. C corporations can claim the deduction on Form 1120, line 25. To figure your domestic production activities deduction (DPAD) you have to use Form 8903. |

| Form 8903 can be used by individuals, corporations, cooperatives, estates, and trusts to figure their allowable DPAD from certain trade or business activities. Shareholders of S corporations and partners must use information provided by the S corporation or partnership to figure their allowable DPAD. Beneficiaries of an estate or trust must use information provided by the estate or trust to figure their allowable DPAD. Patrons of certain agricultural or horticultural cooperatives may be allocated a share of the cooperative's DPAD. |

|

| Small business can use the simplified overall method to calculate DPAD, by which your total cost of goods sold and other deductions, expenses, and losses are ratably apportioned between DPGR and non-DPGR based on relative gross receipts. |

| You generally can use the simplified deduction method to apportion other deductions, expenses, and losses (but not cost of goods sold) between DPGR and non-DPGR if you meet either of the following tests: |

|

|

| Under the simplified deduction method, your other trade or business deductions, expenses, or losses are ratably apportioned between DPGR and non-DPGR based on relative gross receipts. You do not have to meet any tests to use the section 861 method. Under the section 861 method, you generally must apply the rules of the section 861 regulations to allocate and apportion other trade or business deductions, expenses, or losses between DPGR and non-DPGR. Section 199 is treated as an “operative section” described in Regulations section 1.861-8(f). |

| To figure your Form W-2 wages, you can use one of the following three methods: |

|

|

|

|

After you figure Form W-2 wages, see Form W-2 Wages Allocable to DPGR on page 8 to determine the Form W-2 wages to report on line 16 of Form 8903.

|

| This is just a short and simplified overview of the domestic production activities deduction, but it is more than enough for you to realize that professional help is definitely necessary to navigate through all the rules and exceptions to the rules, and to finally calculate your deduction through one of the many methods available. |