| Fill in Form 6251 instead of using the worksheet if you claimed or received any of the following item: |

|

|

|

Accelerated depreciation. |

|

|

|

|

Tax-exempt interest from private activity bonds. |

|

|

|

|

|

Intangible drilling, circulation, research, experimental, or mining costs. |

|

|

|

|

Amortization of pollution-control facilities or depletion. |

|

|

|

|

|

|

|

|

Income or (loss) from tax-shelter farm activities, passive activities, partnerships, S corporations, or activities for which you aren't at risk. |

|

|

|

|

Income from long-term contracts not figured using the percentage-of-completion method. |

|

|

|

|

Investment interest expense reported on Form 4952. |

|

|

|

|

Net operating loss deduction. |

|

|

|

|

AMT adjustments from an estate, trust, electing large partnership, or cooperative. |

|

|

|

|

Section 1202 exclusion. |

|

|

|

|

Stock by exercising an incentive stock option and you didn't dispose of the stock in the same year. |

|

|

|

|

Any general business credit claimed on Form 3800 if either line 6 (in Part I) or line 25 of Form 3800 is more than zero. |

|

|

|

|

Qualified electric vehicle credit. |

|

|

|

|

Alternative fuel vehicle refueling property tax. |

|

|

|

|

Credit for prior year minimum tax. |

|

|

|

|

Foreign tax credit. |

|

|

|

|

Net qualified disaster loss and you are reporting your standard deduction on Schedule A, line 16. |

|

|

If you're not liable for AMT this year, but you paid AMT in one or more previous years, you may be eligible to take a special minimum tax credit against your regular tax this year. If eligible, you should complete and attach Form 8801, Credit for Prior Year Minimum Tax - Individuals, Estates, and Trusts to claim the minimum tax credit.

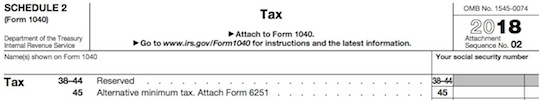

Schedule 2 also includes the Excess Advance Premium Tax Credit Repayment.

The premium tax credit helps pay premiums for health insurance purchased from the Marketplace. Eligible individuals may have advance payments of the premium tax credit paid on their behalf directly to the insurance company.

If you, your spouse with whom you are filing a joint return, or your dependent was enrolled in coverage purchased from the Marketplace and advance payments of the premium tax credit were made for the coverage, complete Form 8962, Premium Tax Credit, to reconcile the advance payments with your premium tax credit. The same Form 8962 is also used to claim the premium tax credit for those individuals who are eligible |

|

|

|

|

You (or whoever enrolled you) should have received Form 1095-A from the Marketplace with information about your coverage and any advance credit payments. If the advance credit payments were more than the premium tax credit you can claim, the amount you must repay will be shown on Form 8962, line 29.

You may have to repay excess advance payments of the premium tax credit even if someone else enrolled you, your spouse, or your dependent in Marketplace coverage. In that case, another individual may have received the Form 1095-A for the coverage.

You also may have to repay excess advance payments of the premium tax credit if you enrolled an individual in coverage through the Marketplace, you don’t claim the individual as a dependent on your return, and no one else claims that individual as a dependent.

If all this seems complicated, know that it really is and you should always consult a tax professional who can guide you through the maze of income tax, credits and deductions efficiently and legally in all your dealings with the IRS. |