|

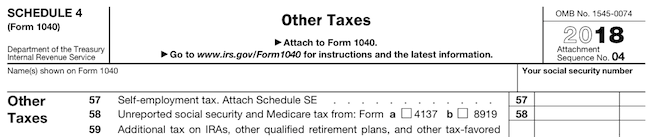

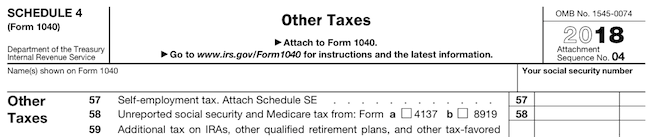

| We are now half way through dissecting the 6 complementary schedules to the new Form 1040 and, apparently, running short on nice introductions to the topic! As a matter of fact, Schedule 4 is quite an interesting subject among its peers.

You are instructed to use Schedule 4 if you have other taxes that cannot be entered on Form 1040. These generally include items that were in the "Other Taxes" section of the 2017 Form 1040. The amount on Schedule 4, line 64, will be entered on Form 1040, line 14.

Like its other siblings, Schedule 4 consists of just a few lines, but do not let that deceive you, as those lines cover a wide range of taxes, some more common, other less so.

You can find more details about schedule 4 lines in the Instructions for Form 1040.

Line 57 - Self-employment tax

Self-employment tax is a tax consisting of Social Security and Medicare taxes primarily for individuals who work for themselves. Self-employed people who make less than $400 from self-employment don't have to pay any tax. The others must file a tax return and pay the tax, even if their total income would otherwise leave them not having to prepare a return at all.

You are considered self-employed if you are: a sole proprietor of a business or trade, an independent contractor, or part of a partnership that carries on a trade or business.

The self-employment tax rate is 15.3% and you figure it on Schedule SE that you have to attach to your Form 1040.

Line 58 - Unreported Social Security and Medicare Tax from Forms 4137 and 8919

If you received tips of $20 or more in any month and you didn't report the full amount to your employer, you must pay the social security and Medicare or railroad retirement (RRTA) tax on the unreported tips.To figure the social security and Medicare tax, use Form 4137. You may be charged a penalty equal to 50% of the social security and Medicare or RRTA tax due on tips you received but didn't report to your employer.

|

|

|

|

|

If you are an employee who received wages from an employer who didn't withhold social security and Medicare tax from your wages, use Form 8919 to figure your share of the unreported tax.

Line 59 - Additional Tax on IRAs, Other Qualified Retirement Plans, etc.

Check Form 5329, Additional Taxes on Qualified Plans (including IRAs) and Other Tax- Favored Accounts, and its instructions to find out if you owe this tax and for definitions of the terms used, if any of the following apply: |

|

|

|

You received an early distribution from (a) an IRA or other qualified retirement plan, (b) an annuity, or (c) a modified endowment contract entered into after June 20, 1988, and the total distribution wasn't rolled over. |

|

|

|

|

Excess contributions were made to your IRA, Coverdell education savings account, Archer MSA, health savings account, or ABLE account. |

|

|

|

|

You received a taxable distribution from a Coverdell ESA, qualified tuition program, or ABLE account. |

|

|

|

|

You were born before July 1, 1947, and didn't take the minimum required distribution from your IRA or other qualified retirement plan. |

|

|

|

|

|

|

|

Line 60a - Household Employment Taxes

Enter the household employment taxes you owe for having a household employee. If any of the following apply, see Schedule H, Household Employment Taxes, and its instructions to find out if you owe these taxes: |

|

|

|

You paid any one household employee (defined below) cash wages of $2,100 or more in 2018. Cash wages include wages paid by check, money order, etc. But don’t count amounts paid to an employee who was under age 18 at any time in 2018 and was a student. |

|

|

|

|

You withheld federal income tax during 2018 at the request of any household employee. |

|

|

|

|

You paid total cash wages of $1,000 or more in any calendar quarter of 2017 or 2018 to household employees. |

|

|

|

|

| Any person who does household work is a household employee if you can control what will be done and how it will be done. Household work includes work done in or around your home by babysitters, nannies, health aides, housekeepers, yard workers, and similar domestic workers. |

|

Line 60b - First-Time Homebuyer Credit Repayment

Enter the first-time homebuyer credit you have to repay if you bought the home in 2008. If you bought the home in 2008 and owned and used it as your main home for all of 2018, you can enter your 2018 repayment on this line without attaching Form 5405, First-Time Homebuyer Credit and Repayment of the Credit. Check the Form 5405 instructions for details and for exceptions to the repayment rule.

|

|

Line 61 - Health Care: Individual Responsibility

If you can’t check the "Full-year health care coverage or exempt" box on page 1 of Form 1040, you must generally report a shared responsibility payment on line 61 for each month that you, your spouse (if filing jointly), or someone you can or do claim as a dependent didn’t have coverage or claim a coverage exemption.

|

|

|

|

|

|

|

|

| If you can claim any part-year exemptions or exemptions for specific members of your household, use Form 8965, Health Coverage Exemptions. This will reduce the amount of your shared responsibility payment. See the Instructions for Form 8965 for information on coverage exemptions and figuring the shared responsibility payment. |

|

|

If you or someone in your household had minimum essential coverage in 2018, the provider of that coverage is required to send you and the IRS a Form 1095-A, 1095- B, or 1095-C (with Part III completed) that lists individuals in your family who were enrolled in the coverage and shows their months of coverage.

You should receive Form 1095-A by early February 2019 and Form 1095-B or 1095- C by early March 2019, if applicable. You don’t need to wait to receive your Form 1095-B or 1095-C to file your return. You may rely on other information about your coverage to complete line 61.

Don’t include Form 1095-A, Form 1095-B, or Form 1095-C with your tax return.

|

|

|

|

|

Line 62 - Other Taxes

Use line 62 to report any taxes not reported elsewhere on your return or other schedules. To find out if you owe the tax, see the form or publication indicated. Enter on line 62 the total of all the following taxes you owe. |

|

| - |

Additional Medicare Tax. |

|

|

| See Form 8959, Additional Medicare Tax, and its instructions if the total of your 2018 wages and any self-employment income was more than: |

|

|

|

$125,000 if married filing separately; |

|

|

|

|

|

$250,000 if married filing jointly; or |

|

|

|

|

|

$200,000 if single, head of household, or qualifying widow(er). |

|

|

|

Also see Form 8959 if you had railroad retirement (RRTA) compensation that was more than the amount just listed that applies to you.

If you are married filing jointly and either you or your spouse had wages or RRTA compensation of more than $200,000, your employer may have withheld Additional Medicare Tax even if you don’t owe the tax. In that case, you may be able to get a refund of the tax withheld.

Check box a if you owe the tax. |

|

| - |

Net Investment Income Tax. |

|

|

| See Form 8960, Net Investment Income Tax Individuals, Estates, and Trusts, and its instructions if the amount on Form 1040, line 7 (which shows the adjusted gross income), is more than: |

|

|

|

$125,000 if married filing separately; |

|

|

|

|

|

$250,000 if married filing jointly; or or qualifying widow(er), |

|

|

|

|

|

$200,000 if single, head of household. |

|

|

|

| If you file Form 2555, Foreign Earned Income (or 2555-EZ), see Form 8960 and its instructions if the amount on Form 1040, line 7 (AGI), is more than: |

|

|

|

$21,100 if married filing separately, |

|

|

|

|

|

$146,100 if married filing jointly or qualifying widow(er), or |

|

|

|

|

|

$96,100 if single or head of household. |

|

|

|

| Check box b if you owe the tax. |

|

|

|

|

Line 62 also has a box c to be checked for a long list of other taxes that include: additional tax on HSA and MSA accounts distributions, recapture of credits (for investments, low-income housing credit, new markets credit, etc.), recapture of federal mortgage subsidy, tax on accumulation distribution of trusts, etc.

You are instructed to check box c and, in the space next to that box, enter the amount of the tax and the code that identifies it. If you need more room, attach a statement listing the amount of each tax and the code.

Line 63 is designated for reporting the Section 965 net tax liability installment from Form 965-A. This new form is used to report a taxpayer’s net 965 tax liability for each tax year in which a taxpayer must report or pay section 965 amounts.

Section 965 of the Code was amended by the new tax law and, as a result, certain taxpayers are required to include in income an amount (a section 965(a) inclusion amount) based on the accumulated post-1986 deferred foreign income of certain foreign corporations (specified foreign corporations) they own either directly or indirectly through other entities. (Line 63 will become a non-entry area for 2019.) |

|

|

|

|

| As mentioned at the beginning of this newsletter, schedule 4 may look short, but very few things tax-related are simple. Therefore, we always advise you to enroll help from a tax professional and make sure you file an accurate return, minimize your tax liability, and take advantage of all the credits and deductions you are entitled to. |

|

|