|

| Leaving out an introduction that would resemble the previous ones probably too much, let us further explore the six schedules complementing Form 1040 for tax year 2018.

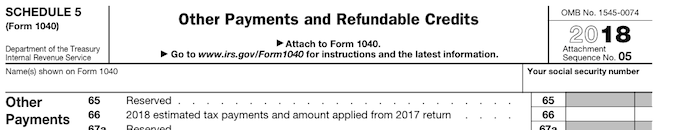

We are now at Schedule 5 which is dedicated to other payments or refundable items that were entered in the "Payments" section of the 2017 Form 1040. The amount from Schedule 5, line 75, will be entered in the space indicated on Form 1040, line 17.

Of the eleven lines that make up Schedule 5, four of them are reserved, meaning that, at the time the schedules were ready to be printed, some formerly claimed credits had expired. Lines shown as "Reserved" were kept in case Congress extended the credits for 2018.

|

|

|

|

|

Line 66 - 2018 Estimated Tax Payments

This is where you must enter any estimated federal income tax payments you made for 2018. Include any overpayment that you applied to your 2018 estimated tax from your 2017 return, or an amended return (Form 1040X).

If the amount of income tax withheld from your salary or pension is not enough, or if you receive income such as interest, dividends, alimony, self-employment income, capital gains, prizes and awards, you may have to make estimated tax payments. If you are in business for yourself, you generally need to make estimated tax payments.

If you and your spouse paid joint estimated tax but are now filing separate income tax returns, you can divide the amount paid in any way you choose as long as you both agree. If you can't agree, you must divide the payments in proportion to each spouse's individual tax as shown on your separate returns for 2018.

If you or your spouse paid separate estimated tax but you are now filing a joint return, add the amounts you each paid. Follow these instructions even if your spouse died in 2018 or in 2019 before filing a 2018 return.

As you may remember, refundable credits can reduce your tax liability below zero and allow you to receive a tax refund. If you qualify for a refundable credit and the amount of the credit is larger than the tax you owe, you will receive a refund for the difference.

These credits are treated just the same as taxes you've paid in through withholding or estimated quarterly payments. |

|

Line 70 - Net Premium Tax Credit

The premium tax credit helps pay for health insurance purchased through the Marketplace. You may be eligible to claim the premium tax credit if you, your spouse, or a dependent enrolled in health insurance through the Marketplace. The credit provides financial assistance to pay the premiums for the qualified health plan offered through a Marketplace by reducing the amount of tax you owe, giving you a refund, or increasing your refund amount.

Eligible individuals may have advance payments of the premium tax credit made on their behalf directly to the insurance company. You (or whoever enrolled you) should have received Form 1095-A from the Marketplace with information about your coverage and any advance credit payments.

|

|

|

|

|

| Complete Form 8962, Premium Tax Credit, to determine the amount of your premium tax credit, if any. If the premium tax credit you can claim exceeds your advance credit payments, your net premium tax credit will be shown on Form 8962, line 26. Enter that amount, if any, on line 70. |

|

|

|

Line 71 - Amount Paid With Request for Extension to File

If you got an automatic extension of time to file Form 1040 by filing Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, or by making a payment, enter the amount of the payment or any amount you paid with Form 4868.

If you paid by debit or credit card, don’t include on line 71 the convenience fee you were charged.

Also, include any amounts paid with Form 2350, which is for U.S. citizens and resident aliens abroad who expect to qualify for special tax treatment . |

|

|

Line 72 - Excess Social Security and Tier 1 RRTA Tax Withheld

If you, or your spouse if filing a joint return, had more than one employer for 2018 and total wages of more than $128,400, too much social security or tier 1 railroad retirement (RRTA) tax may have been withheld.

You can take a credit on this line for the amount withheld in excess of $7,960.80. But if any one employer withheld more than $7,960.80, you can't claim the excess on your return. The employer should adjust the tax for you.

If the employer doesn't adjust the over-collection, you can file a claim for refund using Form 843, Claim for Refund and Request for Abatement. Figure this amount separately for you and your spouse. You can't claim a refund for excess tier 2 RRTA tax on Form 1040. Instead, use Form 843.

|

|

Line 73 - Credit for Federal Tax on Fuels

Enter any credit for federal excise taxes paid on fuels that are ultimately used for a nontaxable purpose (for example, an off-highway business use). Attach Form 4136, Credit for Federal Tax Paid on Fuels, which is used to claim: (1) a credit for certain nontaxable uses (or sales) of fuel during your income tax year, (2) the alternative fuel credit, and (3) a credit for blending a diesel-water fuel emulsion.

|

|

|

|

|

You must include in your gross income the amount of the credit if you took a deduction on your tax return that included the amount of the taxes and that deduction reduced your income tax liability.

Line 74 - Check the box or boxes on this line to report any credit from Form 2439, Notice to Shareholder of Undistributed Long-Term Capital Gains, or Form 8885, Health Coverage Tax Credit.

If you are claiming a credit for repayment of amounts you included in your income in an earlier year because it appeared you had a right to the income, include the credit on line 74. Check box d and enter "I.R.C. 1341" in the space next to that box. See Pub. 525 for details about this credit.

If you made a tax payment that doesn't belong on any other line, include the payment on line 74. Check box d and enter "Tax" in the space next to that box. |

|

|

If you have a net section 965 inclusion in 2018 and have elected to pay your net 965 tax liability in installments, check box d and enter “TAX” and the amount of net 965 tax liability remaining.

If you check more than one box, enter the total of the line 74 credits and payments.

These instructions, which can be found at the end of the instructions to Form1040, contain, for the most part, minimal information on various taxes, credits, and deductions. Therefore, you are directed to other forms, instructions, publications, and sections of the tax code, in order to find all necessary information.

As for us, we prefer to direct you to contact a tax professional in all your dealings with the IRS.

|

|

|

|

|

|

|

|

|

|