|

We are at the end of our little incursion into the six schedules accompanying the new From 1040.

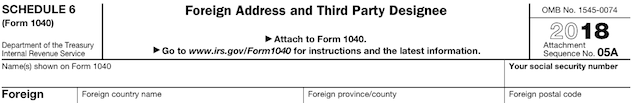

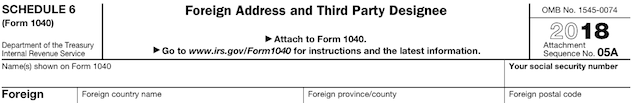

Schedule 6 is the shortest, has no numbered lines, nor reserved lines, just two topics to be entered if you have a foreign address or want to allow another person (other than your paid preparer) to discuss this return with the IRS.

Foreign Address

If you have a foreign address, complete the address section on page 1 of Form 1040, then complete Schedule 6 to enter the foreign country name, foreign province and county, and foreign postal code. When entering your address on page 1 of Form 1040, enter the city name on the appropriate line. Do not enter any other information on that line. Do not abbreviate the country name. Follow the country’s practice for entering the postal code and the name of the province, county, or state.

|

|

|

|

|

In general, all US citizens living and working abroad are required by law to file an annual US tax return. You should also keep in mind that the address on your tax return becomes your address of record with the IRS. Any correspondence the IRS may need to send will go to that address.

Even if you have a foreign address, the IRS regulations require a U.S. bank account to receive your tax refund, and you'll need a U.S. bank account (or credit/debit card with a U.S. billing address) if paying additional federal taxes owed.

When you live overseas, you are allowed an automatic two-month extension to file your tax return, until June 15th. No extension request is necessary to file at this date, and no penalty will be assessed on taxes due if paid by this date. However, interest will be charged on taxes not paid by April 15. If you have been living overseas for at least a year, this is the deadline you will normally need to observe. |

|

Third Party Designee

A third party designee for federal tax purposes is an individual that is not the taxpayer or spouse who is authorized to speak to the IRS with regard to the return on which they are designated. The third party designee can be a person, company, organization or partnership.

There are two major reasons for granting a third party authorization for the purpose of resolving your federal tax issues.

The first reason for granting an authorization is for the purpose of allowing an individual to represent you in tax matters before the IRS. This authorization is a "Power of Attorney" and is submitted using Form 2848, Power of Attorney and Declaration of Representative .

A Power of Attorney (POA) allows the third party to represent you before the IRS. The authorized individual can advocate, negotiate and sign on your behalf. They can argue facts and the application of law. POAs can receive copies of notices and transcripts of your account.

POAs include attorneys, certified public accountants, enrolled agents, general partners, full time employees, family members, and others. |

|

The second reason is to allow any individual, corporation, firm, organization or partnership you designate, your appointee, to inspect and/or receive your confidential tax information in any office of the IRS for the type of tax and years or periods you list on Form 8821, Tax Information Authorization.

|

|

| Tax Information Authorizations (TIAs) allow your appointee to inspect or receive confidential tax information for the tax matters and periods you specify. The appointee of a TIA can be anyone you choose, including "family and friends”. Form 8821 is also used to delete or revoke prior tax information authorizations. |

|

|

|

| TIAs can be submitted in writing or can be done over the phone. There are many different TIAs. The paper Form 8821, has the same authority as the Oral Tax Information Authorization. It allows your appointee to receive verbal or written account information (transcripts) and copies of IRS notices. |

|

|

In certain circumstances, the IRS can accept oral authorizations from taxpayers to discuss their confidential tax return information with third parties. For example, if you bring a third party to an interview with the IRS or involve a third party in a telephone conversation with the IRS, the IRS can disclose your confidential tax return information to that third party after confirming your identity and the identity of the third party, as well as confirming with you the issues or matters to be discussed and what confidential tax return information the IRS may disclose in order to enable the third party to assist you.

An oral authorization is limited to the conversation in which the taxpayer provides the authorization. Unless it is stated otherwise, the oral authorization is automatically revoked once the conversation has ended. The IRS cannot subsequently discuss your confidential tax return information with that or any other third party until it receives a new authorization.

Form 8821 can be mailed in, faxed in or delivered to an area office. The Oral Tax Information Authority can be submitted by calling (800) 829-1040.

If you want to allow a friend, a family member, or any other person you choose (other than your paid preparer) to discuss your 2018 tax return with the IRS, check the "Yes" box in the "Third Party Designee" section of Schedule 6. Also, enter the designee's name, phone number, and any five digits the designee chooses as his or her personal identification number (PIN).

If you want your paid preparer to be your third party designee, check the "3rd Party Designee" box on page 1 of Form 1040. Do not complete Schedule 6.

|

|

|

|

|

|

If you check the "Yes" box, you, and your spouse if filing a joint return, are authorizing the IRS to call the designee to answer any questions that may arise during the processing of your return. You also are authorizing the designee to:

|

|

- Give the IRS any information that is missing from your return,

- Call the IRS for information about the processing of your return or the status of your refund or payment(s),

- Receive copies of notices or transcripts related to your return, upon request, and

- Respond to certain IRS notices about math errors, offsets, and return preparation.

|

|

|

|

|

This authorization will automatically end no later than the due date (not counting extensions) for filing your 2019 tax return. This is April 15, 2020, for most people.

Needless to remind you (although we obviously do) that, with all the changes brought by the Tax Cuts and Jobs Act, it is now more necessary than ever to use a tax professional in all your dealings with the IRS so you can have a safe and peaceful relationship with the taxman. |

|

|

|

|

|